Japan and Economics

日本の経済

... japan viewed through an economist's lens どうぞ!

Wednesday, April 15, 2015

Blogging primarily at Autos and Economics

Saturday, January 3, 2015

Autos and Economics: Waiting for the stars to align: Japan's Consumptio...

Since writing this Abe called a snap election, which the opposition lost; proposed tax cuts that will undermine part of the benefits of the 1st tax increase but which will do nothing to stimulate the economy (since corporates are awash with cash while interest rates are low in real terms, taxes aren't what's holding them back); postponed the 2nd tax increase; and ... the economy appears to again be re-entering the world of (mild) deflation. At some point I'll revisit these issues.

mike smitka

Saturday, November 30, 2013

Real inflation? – or time to revive old concepts?

Issue

The "flash" release of consumer prices in central Tokyo for November show Japan's CPI is back in positive territory for the first time in 15 years, with accompanying headlines. Never mind that the current level is barely positive (and that for most of the period the level was barely negative); we're told that Abenomics is working.

That judgement is premature. To date the rise in consumer prices is limited to energy (including the hike in electricity prices thanks to the nuclear shut-down) and imported goods (the weaker yen). While the overall index shows a 0.9% year-over-year rise, that falls to 0.2% once food and energy are excluded. Then there are import prices; TVs contributed 0.1 percentage points to the total, while overseas "package" vacations were up 12.6% in price. However, domestic services are the biggest part of consumption, and health care costs dropped 0.9% relative to November 2012. So in my reading the data provide no indication that the rise in consumer prices will continue after these one-time effects – the nuclear shutdown, the yen depreciation – work through the economy. [See here for the data.]

Theory

That reading is contingent upon an underlying view of inflation dynamics. At one time discussions divided into "cost-push" and "demand-pull" inflation. First, that approach relied upon an arbitrary separation into demand-side and supply-side factors. Second, it provided no help in understanding hyperinflations, something that was ignored by the parochial Anglo-American base of the profession.

For that task, the monetarist framework developed by Irving Fisher and later used by Milton Friedman worked well. However, Friedman's framework had its own defects. The core accounting identity MV = PY worked only as long as the velocity of money V was stable, which turned out to be a function of the tightly regulated US financial system. (Today central banks appear to have little control over the left-hand side, with shifts in monetary policy offset by changes in the willingness to hold money. Money, in other words, is endogenous.) Meanwhile, at low levels of inflation it provided no guidance on how a change in money might be split among changes in the price level P and output Y. That's today's world.

Then came the stubborn US inflation of the 1970s. The "push-me, pull-me" approach helped not at all, as both seemed to be at play, and offered only vague policy advice – did it really suggest using wage-and-price controls? Instead a new expectations-based approach seemed to work better: as long as expectations of future inflation remained strong, inflation was self-reinforcing. It also proved easy to introduce (rational) expectations into formal models using a monetarist framework, and of course novelty is important for up-and-coming economists to make their mark. The new models generated excitement, and also appealed to the conservatives who read stable-policy rules (rather than central bank discretion) into the monetarist framework.

Now the anti-inflationary actions of the Bank of Japan in the mid-1970s and the US Fed in 1979-82 seemed to fit both the expectations framework: high interest rates were viewed as a credible signal of a commitment to lower inflation, and a period of high rates did indeed lead to a sharp (and most important for the model, enduring) drop in inflation. Of course a more conventional "Keynesian" model generated the same initial results, because high interest rates clearly cut into (aggregate) demand by repressing business investment, housing and consumer durables. But such models had been discredited and the new expectations/monetarist models seemed to work.

Japanese inflation

Back to Japanese inflation. There's no indication inflation expectations are now higher. Long-term bond rates remain extremely low, and have fallen rather than risen, which is not consistent with a stable 2% inflation rate down the road. Surveys show consumers expect 2% inflation – but discomfiting to the expectations view, that has been the case for many years. The more aggressive Bank of Japan policy has led to some substitution from money into foreign assets (hence the weak yen). Trade deficits reinforce depreciation. Yet the current account (trade plus net capital) remains positive; Japan is a global rentier, earning substantial foreign income. So I don't think the asset reallocation will continue forever. Over the long run the yen will not stay weak – though the time horizon is too long and uncertain to make speculation profitable, particular as asset returns outside Japan are also part of the story. The bottom line remains that the "push" of depreciation is one-time, and if anything will reverse.

Now energy prices may go up, or they may go down – no betting there. However, natural gas prices in Japan remain unusually high, given prices elsewhere. That suggests that over time energy prices will decline, as import capacity improves and power plants shift to that cheaper source. With virtually all of Japan's nuclear generating capacity shuttered, there's no upside to prices, only downside. So again, the "push" from that end is one-time and if anything will reverse.

So expectations aren't leading to direct price hikes, the direct impact of monetary policy has been minimal, and "push" from the indirect portfolio effect and from Japan's failed energy policy won't continue.

What of "pull"? The impact there is through labor markets and product markets. While labor indicators are improving, all measures point to flat wages and continued excess capacity in product markets. But since Japan is a service economy, wages really are key. Were the economy to keep growing – ah, but in April we have the consumption tax increase. So with the uncertainty that introduces (or rather, the certainty of slower consumption growth), wages won't rise in this year's shunto (annual large-firm spring wage negotiations).

Conclusion

Perhaps come 2015 there will be "real" inflation, when "push" and "pull" are muddied and ongoing price increases are reflected in expectations and wage changes. For an economist two years is the distant future. I wasn't presented with a crystal ball when I marched to receive my PhD – all I got was a handsome piece of paper in Yale blue. To the extent that I can peer into the future, it is because I rely on the momentum of an entire economy and a model of how pieces interact. Errors from being a little off in reading those forces cumulate, and the future typically includes surprises that add to the size of the error term. Momentum means there's little value in updating this story monthly, and I chose not to become a "house" economist whose job mandates doing so anyway. My sense is it won't be worth revisiting the inflation story until summer 2014, when more is known of the impact of the consumption tax increase, of energy prices and policies, and of shifts in big-firm employment and wages.

Addendum: I deliberately kept narrow the overview of shifting macro viewpoints: no mention of a Phillips Curve, no mention of Real Business Cycles, much less how these all come together in one or another flavor of DSGE. If you're an economist that's not central, you know the other pieces. If you're not, these other pieces complement rather than overturn what I do trace.

Thursday, October 3, 2013

Autos and Industrial Policy

Saturday, September 28, 2013

Auto Supplier Price-fixing and Japan

The conspiracy of Japanese wiring and electronics suppliers to put the screws to Toyota and other customers has now led to the largest antitrust action in history. What we know appears stupendous in scope. To date 20 suppliers have paid fines totaling $1.6 billion in the US (an additional $347 million in fines in Europe and Japan brings the total to $1.95 billion). Some 21 executives have pleaded guilty to felony antitrust charges including jail time and financial penalties. Wired participants, secret locations, coded communication and an expanding list of auto parts and firms, spanning 10 or more years and at least 4 continents. Wild!

...once customers have been screwed for a while, it starts to feel normal

Then there's what we don't know. To date all of those charged have pleaded guilty. As a result, the Department of Justice (and their counterparts in Japan, the EU, Canada, Mexico, Korea and Australia) have not had to enter detailed charges into the public record. With no trial, no evidence need be made public – and even though every corporate law firm in Detroit is racking up billable hours beyond their wildest imagination, those involved have done a truly impressive job of keeping their mouths shut.

And with cause: private lawsuits in the US can seek treble damages, and at least 45 such have been filed (and for now consolidated in the District Court in Detroit). The fines that firms have willingly paid suggest those fines are well below the maximum – though back of the envelope calculations suggests DOJ used a rule of thumb of 8% of revenue for the early wire harness settlements. These and other firms may however have benefitted from the antitrust Amnesty Plus program, which provides for low or even no fines for those who 'fess up' early and help the prosecution. So the amounts could easily hit $5 billion. However, without evidence, such suits will go nowhere, and Federal courts have put a stay on those suits while criminal investigations are ongoing. Attorney General Holder has indicated that the Department of Justice is far from concluding their work; for their part, the Europeans raided six companies this month. But then there are those wiretaps of phones and tapes of meetings: it appears that the DOJ is limiting itself to central players, and going at them with such ironclad cases that they can avoid wasting resources on the morass of a jury trial.

NPR segment …Nine Suppliers Plead Guilty… [mea culpa: they interviewed me]

In some ways, the industry invites conspiracy. The design and engineering process for a new vehicle involves so many components that doing a full start-from-scratch purchase for each part in a vehicle is administratively infeasible; purchasing departments just aren't large enough. So when a Toyota comes out with the next generation Camry or a Ford the next F-150, they will naturally lean towards the incumbent supplier – they know the engineers, they will have the manufacturing capacity. With suppliers involved in the actual design process, they have to be selected before specifications are firm. Yes, the car companies pursue outside bids to try to keep the process honest, and when there is an entirely new component it's a fully competitive bid. Likewise firms with new technology can get their foot in the door – and those are exactly the firms I see as a judge of the Automotive News PACE award competition.

With so many vehicles under development – in the US alone carmakers will launch 365 new vehicles between now and 2015 – it's clear that purchasing departments have fallen down on the job of tracking costs. But these are not the highly engineered items where at present one or two firms control the technology, such as turbos or common rail diesel systems. When I look at a list of the components named in the guilty pleas, they are for the most part not items where new technology is changing the game: starter motors, alternators, seat belts, wire harnesses. While new materials are coming, in the case of harnesses leading to thinner gauges and now even lighter-weight and cost aluminum wires, these products are mature. But this is necessary: you can't readily fix prices when a good isn't a commodity. When you know your and your competitors costs are similar, then you can agree on what the price could be and the level at which your conspiracy can fix it.

Part of the reason is again administrative: car companies with few exceptions have no internal manufacturing capability for the items they procure. They thus rely upon comparisons with past prices, adjusted for changes in the price of materials and known or anticipated productivity improvements. Therein lies the opportunity for a cartel: once suppliers have started screwing their customers, the car companies can come to believe that it's normal. Bids look sensible given past prices. Since harnesses with their miles of wire and hundreds of connectors are one of the most expensive component purchases a car company makes, companies always seek outside bids – but thanks to the conspiracy either find few firms express interest, or come in with ridiculous prices. [For an example see "Ford Alleges…" Automotive News, Aug 5, 2013] This should raise suspicions, but apparently did not set off alarms. While Toyota was firm mentioned in initial guilty pleas, the list of victims now includes most of the industry's major firms. Toyota's purchasing department may have been overwhelmed in its go-go years of the noughts (ending with the early retirement of the firm's top 4 executives), purchasing departments throughout the industry clearly were not up to the task of sniffing out carefully coordinated price fixing.

With wire harnesses, 4 suppliers dominate the Asian market, with Delphi Packard (yes, the name I use is anachronistic) a strong contender elsewhere (and as the one major player not named in this segment, finding that it's suddenly gaining market share in Nagoya). So how did the conspiracy arise? In Japan (as elsewhere) suppliers share panels in engineering conferences and industry associations; ironically, as I found in my own PhD research in the mid-1980s, they may even play golf together at events hosted by their customers. Put them together in the ex-pat supplier community in the US and informal interactions become more likely. Or at least that's my supposition of how things got started, and why it remained undetected in some cases for a full decade.

With stays on the private lawsuits, with uncontested guilty pleas in all the criminal cases, and with those involved so far keeping their lips sealed, few details have come out on the US end. It may be that journalists in Japan can find out more – what goes into the public record may be different, Japan's Freedom of Information Act is stronger than that in the US, and when plied with drinks officials and mid-level auto industry managers may be more willing to speak less-or-more off the record. Journalists and stock analysts should also be asking Toyota about their purchasing operation, about how they could be bamboozled out of so much money and how they're working to fix that. Finally, all should be lauding the Japanese Fair Trade Commission, which in its pursuit of this case is showing that it is more capable than in the past – handling the domestic side of a multinational price-fixing conspiracy – and is willing and able to act in the interest of consumers.

Mike Smitka

Sunday, August 25, 2013

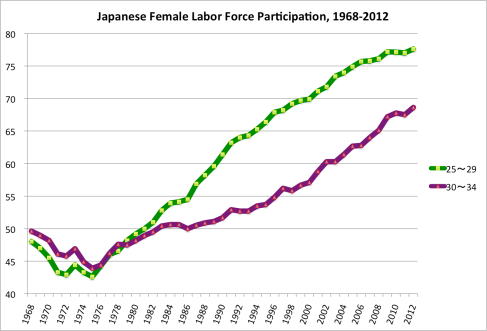

The Rise of Women in Japan's Labor Force

A concurrent set of posts on the NBR Japan Forum is on the role of women in the labor force. At younger ages, the shift towards greater participation is dramatic, a 30 percentage point jump among 25-29 year olds. Participation for women age 30-34 is following in parallel, with about a 13 year lag:

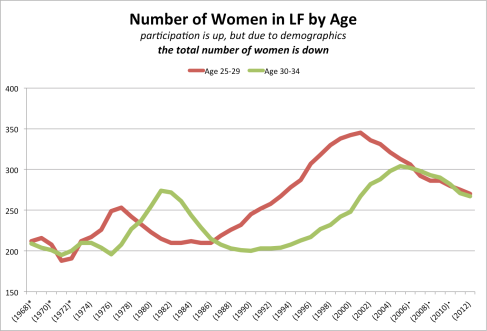

A concurrent set of posts on the NBR Japan Forum is on the role of women in the labor force. At younger ages, the shift towards greater participation is dramatic, a 30 percentage point jump among 25-29 year olds. Participation for women age 30-34 is following in parallel, with about a 13 year lag: However, this is less economically meaningful than at first glance. Women are not going to be able to save Japan from its demographic challenges. Of course it is these very same women who are not having lots of children. But more to the point, these young women are now the only daughters of an already smaller generation of women.

However, this is less economically meaningful than at first glance. Women are not going to be able to save Japan from its demographic challenges. Of course it is these very same women who are not having lots of children. But more to the point, these young women are now the only daughters of an already smaller generation of women.Saturday, August 10, 2013

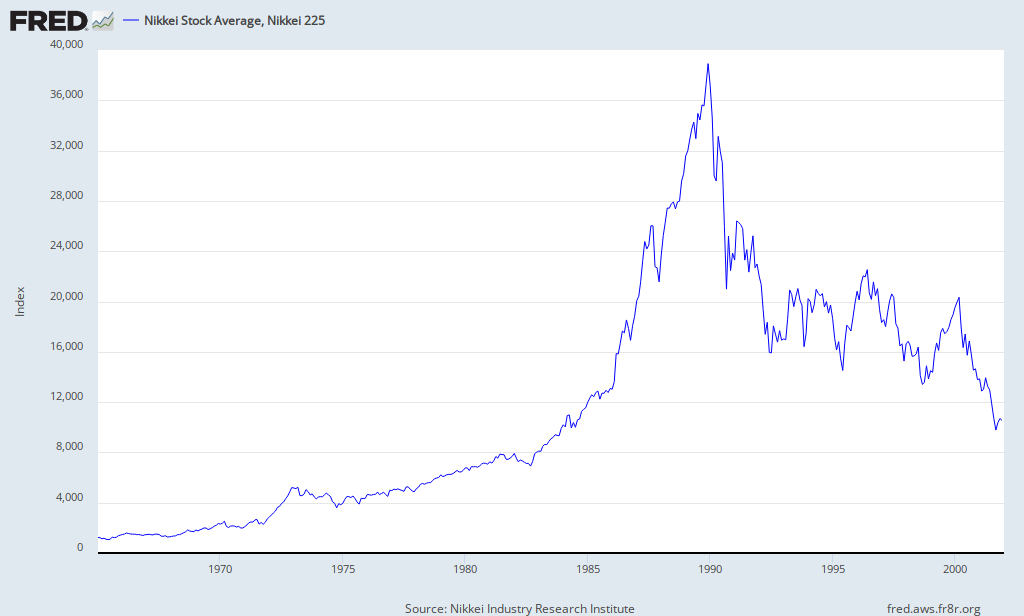

Nikkei Bubble on Slate