Issue

The "flash" release of consumer prices in central Tokyo for November show Japan's CPI is back in positive territory for the first time in 15 years, with accompanying headlines. Never mind that the current level is barely positive (and that for most of the period the level was barely negative); we're told that Abenomics is working.

That judgement is premature. To date the rise in consumer prices is limited to energy (including the hike in electricity prices thanks to the nuclear shut-down) and imported goods (the weaker yen). While the overall index shows a 0.9% year-over-year rise, that falls to 0.2% once food and energy are excluded. Then there are import prices; TVs contributed 0.1 percentage points to the total, while overseas "package" vacations were up 12.6% in price. However, domestic services are the biggest part of consumption, and health care costs dropped 0.9% relative to November 2012. So in my reading the data provide no indication that the rise in consumer prices will continue after these one-time effects – the nuclear shutdown, the yen depreciation – work through the economy. [See here for the data.]

Theory

That reading is contingent upon an underlying view of inflation dynamics. At one time discussions divided into "cost-push" and "demand-pull" inflation. First, that approach relied upon an arbitrary separation into demand-side and supply-side factors. Second, it provided no help in understanding hyperinflations, something that was ignored by the parochial Anglo-American base of the profession.

For that task, the monetarist framework developed by Irving Fisher and later used by Milton Friedman worked well. However, Friedman's framework had its own defects. The core accounting identity MV = PY worked only as long as the velocity of money V was stable, which turned out to be a function of the tightly regulated US financial system. (Today central banks appear to have little control over the left-hand side, with shifts in monetary policy offset by changes in the willingness to hold money. Money, in other words, is endogenous.) Meanwhile, at low levels of inflation it provided no guidance on how a change in money might be split among changes in the price level P and output Y. That's today's world.

Then came the stubborn US inflation of the 1970s. The "push-me, pull-me" approach helped not at all, as both seemed to be at play, and offered only vague policy advice – did it really suggest using wage-and-price controls? Instead a new expectations-based approach seemed to work better: as long as expectations of future inflation remained strong, inflation was self-reinforcing. It also proved easy to introduce (rational) expectations into formal models using a monetarist framework, and of course novelty is important for up-and-coming economists to make their mark. The new models generated excitement, and also appealed to the conservatives who read stable-policy rules (rather than central bank discretion) into the monetarist framework.

Now the anti-inflationary actions of the Bank of Japan in the mid-1970s and the US Fed in 1979-82 seemed to fit both the expectations framework: high interest rates were viewed as a credible signal of a commitment to lower inflation, and a period of high rates did indeed lead to a sharp (and most important for the model, enduring) drop in inflation. Of course a more conventional "Keynesian" model generated the same initial results, because high interest rates clearly cut into (aggregate) demand by repressing business investment, housing and consumer durables. But such models had been discredited and the new expectations/monetarist models seemed to work.

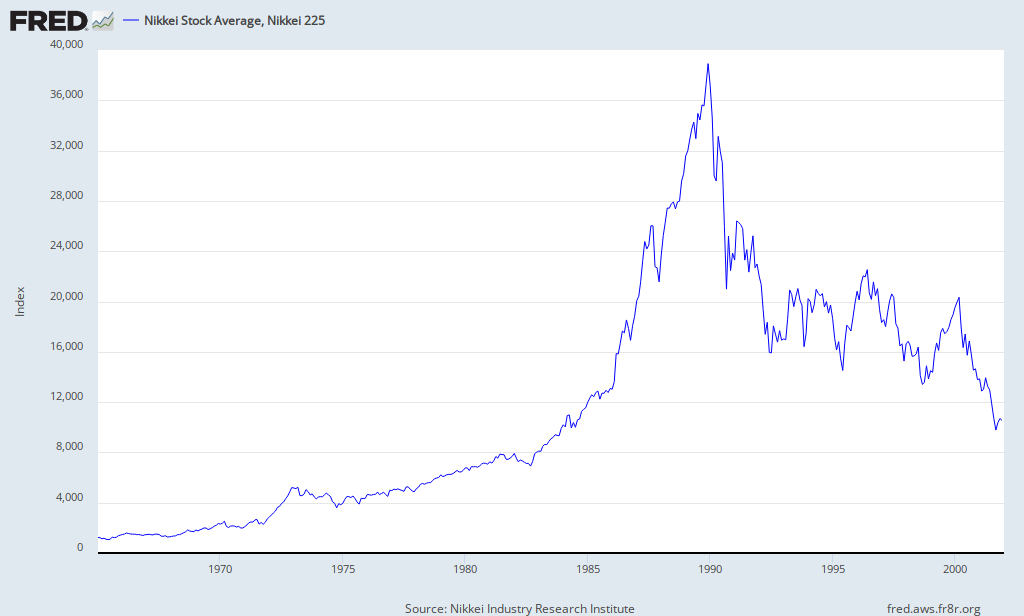

Japanese inflation

Back to Japanese inflation. There's no indication inflation expectations are now higher. Long-term bond rates remain extremely low, and have fallen rather than risen, which is not consistent with a stable 2% inflation rate down the road. Surveys show consumers expect 2% inflation – but discomfiting to the expectations view, that has been the case for many years. The more aggressive Bank of Japan policy has led to some substitution from money into foreign assets (hence the weak yen). Trade deficits reinforce depreciation. Yet the current account (trade plus net capital) remains positive; Japan is a global rentier, earning substantial foreign income. So I don't think the asset reallocation will continue forever. Over the long run the yen will not stay weak – though the time horizon is too long and uncertain to make speculation profitable, particular as asset returns outside Japan are also part of the story. The bottom line remains that the "push" of depreciation is one-time, and if anything will reverse.

Now energy prices may go up, or they may go down – no betting there. However, natural gas prices in Japan remain unusually high, given prices elsewhere. That suggests that over time energy prices will decline, as import capacity improves and power plants shift to that cheaper source. With virtually all of Japan's nuclear generating capacity shuttered, there's no upside to prices, only downside. So again, the "push" from that end is one-time and if anything will reverse.

So expectations aren't leading to direct price hikes, the direct impact of monetary policy has been minimal, and "push" from the indirect portfolio effect and from Japan's failed energy policy won't continue.

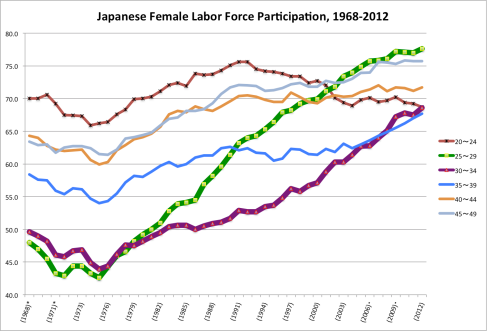

What of "pull"? The impact there is through labor markets and product markets. While labor indicators are improving, all measures point to flat wages and continued excess capacity in product markets. But since Japan is a service economy, wages really are key. Were the economy to keep growing – ah, but in April we have the consumption tax increase. So with the uncertainty that introduces (or rather, the certainty of slower consumption growth), wages won't rise in this year's shunto (annual large-firm spring wage negotiations).

Conclusion

Perhaps come 2015 there will be "real" inflation, when "push" and "pull" are muddied and ongoing price increases are reflected in expectations and wage changes. For an economist two years is the distant future. I wasn't presented with a crystal ball when I marched to receive my PhD – all I got was a handsome piece of paper in Yale blue. To the extent that I can peer into the future, it is because I rely on the momentum of an entire economy and a model of how pieces interact. Errors from being a little off in reading those forces cumulate, and the future typically includes surprises that add to the size of the error term. Momentum means there's little value in updating this story monthly, and I chose not to become a "house" economist whose job mandates doing so anyway. My sense is it won't be worth revisiting the inflation story until summer 2014, when more is known of the impact of the consumption tax increase, of energy prices and policies, and of shifts in big-firm employment and wages.

Addendum: I deliberately kept narrow the overview of shifting macro viewpoints: no mention of a Phillips Curve, no mention of Real Business Cycles, much less how these all come together in one or another flavor of DSGE. If you're an economist that's not central, you know the other pieces. If you're not, these other pieces complement rather than overturn what I do trace.